India Box Office 2025

Film Maker

India Box Office 2025 - Language-Wise Performance with Insights

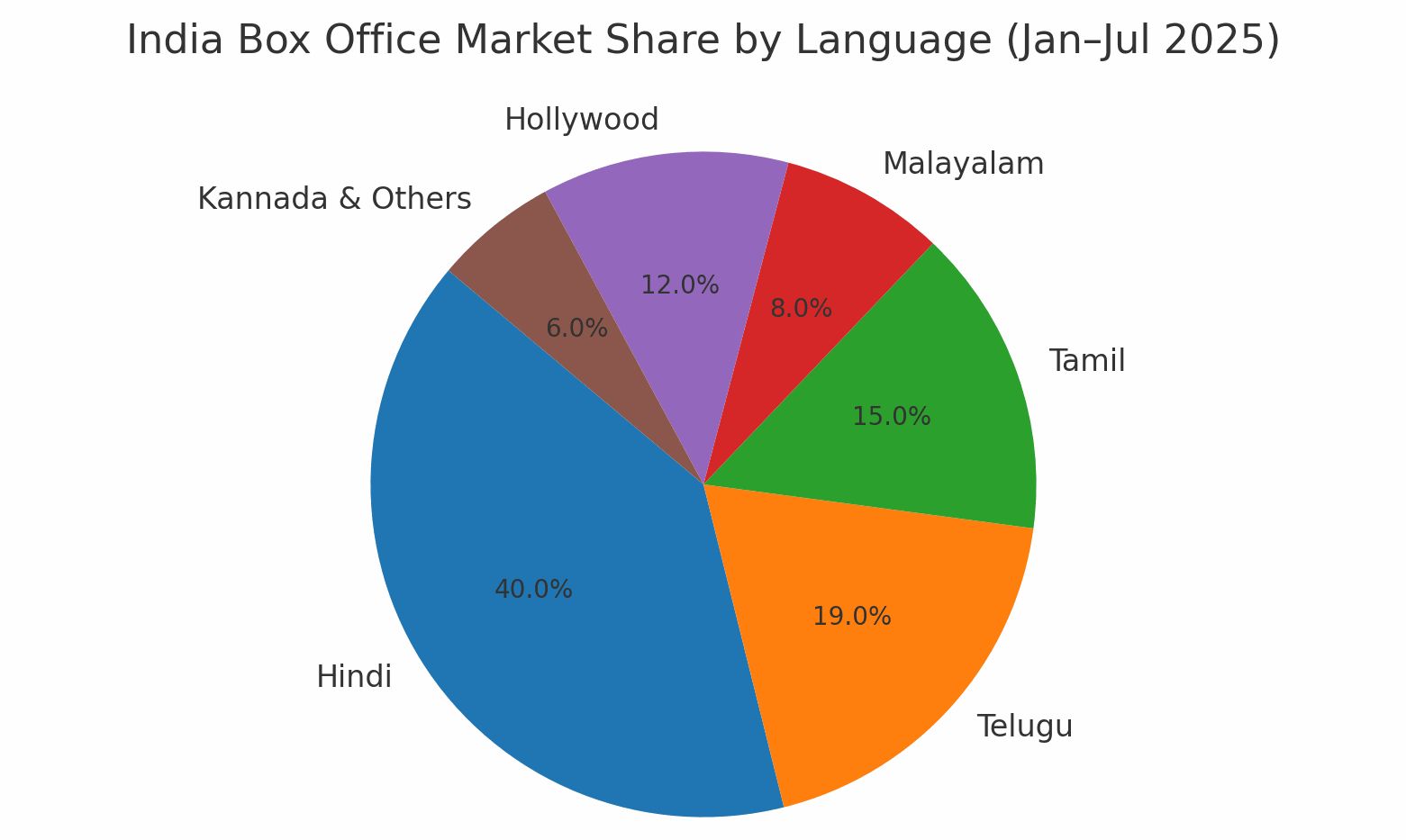

1. Hindi (Bollywood) – 40% share (Jan–Jul 2025)

Key Hits:

-

Chhaava (Rs.693+ crore India gross) – A historical drama with emotional weight.

- Why it worked: Authentic storytelling rooted in Maratha history, massive family appeal, patriotic undertones. Multiplex + single-screen pull.

-

Saiyaara (Rs.500+ crore worldwide) – Romantic-action drama starring Ahaan Panday.

- Why it worked: Youth appeal, strong music album, excellent WOM (word of mouth). Bounced back after weak start due to increased shows.

-

Sitaare Zameen Par – Emotional family film fronted by Aamir Khan.

- Why it worked: Content-driven, focusing on emotions rather than action spectacle.

Insights:

- Content shift: 2025 audience showed fatigue for “overdesigned spectacle” (e.g., War 2 dropped sharply after big opening). They leaned toward emotional resonance.

- Distribution clout: Jio Studios captured ~40% Hindi market share, enabling bigger reach and showtimes.

- Impact of South Dubs: Nearly 1/3rd of Hindi BO came from dubbed South films, signaling Hindi’s growing dependence on pan-India content.

2. Telugu (Tollywood) – 19% share

Key Hits:

-

Game Changer, Sankranthiki Vasthunam, Daaku Maharaaj – Sankranti 2025 winners (Rs.400+ crore combined in Jan).

- Why it worked: Star power (Ram Charan, Mahesh Babu, NTR Jr.), festival release window, mass songs & action.

- Challenges: Despite hits, Tollywood faced Rs.1,000 crore losses in H1 2025 due to over-budgeting (huge salaries, VFX-heavy films not paying off) and piracy leaks.

Insights:

- Telugu films thrive on festival clustering (Jan, Oct), but oversaturation caused audience fatigue.

- Still, Telugu continues to anchor the pan-India template (mass action, emotion + dubbed releases in 4–5 languages).

3. Tamil (Kollywood) – 15% share

Key Hits:

-

Coolie (Rajinikanth) – Rs.200+ crore by week 1.

- Why it worked: Rajinikanth’s superstardom, gangster theme rooted in Chennai culture, but marketed pan-India in Hindi & Telugu.

- Good Bad Ugly (April 2025) – Rs.180+ crore, urban audience favorite.

Insights:

- Tamil films in 2025 balanced star-driven blockbusters with mid-budget urban dramas.

- Rajinikanth, Vijay, Ajith continue to dominate, but the rise of younger stars shows audience readiness for generational shift.

- Tamil films benefited from strong overseas Tamil diaspora (Singapore, Malaysia, Middle East).

4. Malayalam (Mollywood) – 8–13% share

Key Hits:

- L2: Empuraan (Mohanlal) – Rs.265+ crore.

- Thudarum – Rs.235+ crore, social-drama thriller.

Why These Worked:

- Tight scripting, strong performances, realistic tone.

- Malayalam films find critical acclaim + OTT buzz, then ride that to national box office success when dubbed in Hindi/Telugu.

Insights:

- Malayalam cinema’s brand is now “content-first, star-next”.

- Growing pan-India consumption: Viewers in North India willing to watch Malayalam films with subtitles/dubs.

5. Kannada (Sandalwood) – ~6% share

Key Highlight:

-

Su From So – surprise comedy blockbuster, highest-grossing Kannada film 2025.

- Why it worked: Word of mouth + relatability, proving not every hit needs mega stars.

Insights:

- After KGF, Kannada industry has struggled to maintain pan-India momentum.

- 2025 showed content-driven films can still break out locally.

6. Hollywood in India – 12% share (by July)

Key Titles:

- Marvel and franchise films reclaimed urban audiences, pushing Hollywood’s share up from 4% (April) ? 12% (July).

- Multiplex chains prioritized big Hollywood releases, attracting English-speaking youth.

The Pan-India Superstar Factor

2025 reaffirmed that casting multilingual superstars = wider reach:

-

War 2 – Hrithik Roshan (Hindi) + Jr NTR (Telugu) + Kiara Advani (pan-India appeal).

- Opened huge (Rs.50 crore Day 1), showing the power of cross-industry casting, but couldn’t sustain due to weak story.

- Coolie – Tamil original, but aggressively marketed in Telugu + Hindi circuits, making it a pan-India Rajini film.

- Saiyaara – Though a Bollywood film, had pan-India music album and dubbed versions, boosting Tier-2/3 city earnings.

Why Multilingual Casting Matters:

- Larger Opening Day Numbers – Fans from multiple regions ensure Rs.50–100 crore openers.

- Crossover Appeal – Helps break the “regional tag”; audiences feel “this is for us too.”

- OTT & Overseas Value – Multilingual stars increase streaming rights and global presales.

Final Takeaways

- Hindi reclaims dominance but depends heavily on dubbed South films and all-India strategies.

- Telugu/Tamil remain engines of pan-India blockbusters—but need tighter budgets.

- Malayalam emerges as the content powerhouse with pan-India credibility.

- Hollywood regains urban youth share.

- Multilingual superstars are no longer a bonus—they’re a necessity for pan-India success.